Demystifying Homeowner’s Insurance: Are Your Gazebos Fully Covered?

Ever wondered if your gazebo, that charming backyard haven, is covered by insurance? It’s a question many homeowners grapple with. After all, gazebos can be substantial investments and they’re exposed to the same risks as any other part of your property – windstorms, fires or even mischievous neighborhood kids.

Understanding Homeowner’s Insurance Coverage

Delving deeper into the area of homeowner’s insurance, it becomes clear that understanding its intricacies is vital for property owners.

Defining Homeowner’s Insurance

Homeowners’ insurance serves as a financial safeguard against unexpected damages and liabilities. In simpler terms, it acts like your safety net when unforeseen incidents threaten to wreak havoc on your home – be they natural disasters or accidents caused by human error.

Examples include but aren’t limited to fire damage (think faulty wiring sparking an indoor blaze), theft (consider a break-in scenario), personal liability in case someone gets injured within your premises (imagine slipping on icy walkways during winter) among other potential scenarios.

What Does Homeowner’s Insurance Cover?

A typical homeowners’ policy primarily covers four key areas: dwelling protection; additional structures coverage; personal belongings coverages; and liability protection. Dwelling protection refers to main house repairs or rebuilds after events like fires or windstorms— you know those calamities capable of causing significant destruction? That’s where this comes into play!

Additional structures coverage extends protections beyond just the primary residence — think garages, fences…and yes gazebos too! This aspect ensures these extra features also enjoy some degree of security under the blanket of homeowners’ insurance.

Personal belongings such as furniture, electronics and clothing fall under Personal Belongings Coverage if destroyed in insured disasters—or even stolen!

Finally Liability Protection kicks in should someone else get hurt while at your place—an unfortunate incident may lead them filing lawsuit charges against you—for instance tripping over a garden hose left carelessly across the pathway?

Overall but remember policies differ greatly from provider-to-provider so always confirm with yours what exactly their specific plan covers before making any assumptions.

Delving into Gazebos and Insurance

A gazebo is more than just a garden ornament. It’s an essential part of your home that deserves insurance coverage too.

What Is a Gazebo?

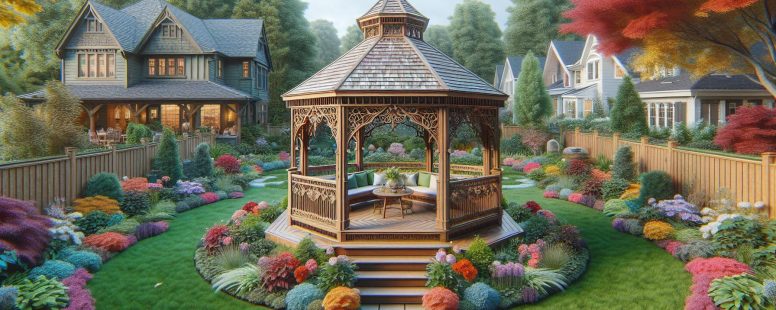

In essence, gazebos are freestanding pavilions often found in gardens or backyards. They’re traditionally octagonal in shape, but modern designs vary widely. Usually open on all sides for panoramic views, they offer shelter from the sun or rain while you enjoy the outdoors.

Gazebos come in various sizes and materials: wood gazebos give off rustic vibes; metal ones exude elegance with their intricate designs; vinyl types provide durability against weather conditions – these are just examples showcasing how versatile this structure can be.

Remember, each type requires different maintenance levels and possesses varying degrees of resistance to environmental damage like decay or rusting—factors you’d want to consider when purchasing homeowners’ insurance.

Importance of Gazebos in Residential Properties

Why should one invest time (and money) into having a gazebo? Well, besides enhancing aesthetic appeal — which by itself increases property value — it also serves practical functions:

- Hosting Outdoor Activities: Be it barbecues during summer afternoons or tea parties under starlit nights – hosting events becomes memorable with picturesque backgrounds provided by gazebos.

- Creating Relaxation Spaces: After long workdays unwind amidst nature’s tranquility right at home—it helps reduce stress significantly.

- Increasing Privacy: Depending on its design and placement—a strategically positioned gazebo can create private outdoor spaces even within bustling neighborhoods.

Are Gazebos Covered by Insurance?

In the area of insurance, gazebos aren’t typically forgotten. The question isn’t if they’re covered, but how and under what conditions? In this section, we’ll investigate deeper into these details.

Differentiating Attached and Detached Gazebos

When it comes to insuring your gazebo, an essential factor that insurers consider is whether it’s attached or detached from your primary dwelling. An attached gazebo shares a common wall with your house or connects directly through a structure like a patio or deck. On the other hand, a detached gazebo stands alone in another part of the property such as garden area.

These classifications matter because most standard homeowner’s insurance policies cover structures connected to main home under ‘dwelling coverage.’ Conversely, standalone fixtures fall under category called ‘other structures’ which may not offer same level protection compared its counterpart.

| Coverage Under Standard Homeowner’s Policy | |

|---|---|

| 1 | Attached Gazebo – Dwelling Coverage |

| 2 | Detached Gazebo – Other Structures |

Knowing distinction between two can guide you on appropriate steps take ensure optimal protection for backyard asset.

Gazebo Coverage under Standard Insurance

Standard homeowners insurance generally includes coverage for additional structures on property beyond primary residence itself – think sheds barns…and yes gazebos too! But extent financial safeguard depends type policy hold company work with variety factors including size value materials used build specific feature among others might influence premium amounts pay out-of-pocket expenses face event claim.

Factors Influencing Gazebo Coverage

There are multiple factors influencing whether or not your gazebo is covered by insurance. The condition and maintenance of the structure, as well as potential risk factors, play a significant role in determining this.

Gazebo Condition and Maintenance

Firstly, let’s talk about the physical state of your gazebo – its condition matters. Regular maintenance ensures that it stays sturdy over time; think of it like keeping up with car services to avoid future problems down the line. If you’ve been neglecting repairs on a broken railing or leaking roof for instance, an insurer may consider this when evaluating coverage eligibility.

Also, gazebos constructed from durable materials such as metal often garner more comprehensive protection compared to those made out of less resilient substances like certain types of wood (pine or cedar). For example: Gazebos built using steel demonstrate strong resistance against adverse weather conditions so making them attractive prospects for insurers who then extend favorable policies toward these structures.

Potential Risk Factors

Now onto potential risks – these too can impact whether an insurance company covers your backyard beauty spot. Common hazards include exposure to harsh elements (hailstorms), human-made dangers (vandalism), wildlife encounters (squirrels gnawing through wooden beams) among others which could damage the structural integrity significantly hence leading towards increased scrutiny during policy underwriting processes by providers.

For instance: Homes located in regions prone to extreme weather events might have higher premiums due their greater likelihood encountering devastating storms whereas properties situated within calm neighborhoods boasting lower crime rates usually attract reduced charges reflecting decreased chances experiencing vandalism related damages respectively.

Steps to Ensure Your Gazebo is Insured

Having a gazebo on your property adds charm and functionality, but it also means another asset that needs protection. This section aims to guide you through the necessary steps for ensuring insurance coverage of your gazebo.

Reviewing the Insurance Policy

Start by examining your homeowner’s policy in detail. Look for clauses related specifically to “additional structures” or “other structures.” These terms generally include gazebos along with other detached constructions like sheds and garages. Note down key factors such as maximum payout limits and any exclusions listed in these sections.

For instance, most policies limit their additional structure coverage up to 10% of the dwelling amount insured; if you’ve got $200,000 on home insurance, they’d cover an extra $20,000 towards other structures including gazebos.

Another aspect worthy of attention is whether ‘replacement cost’ or ‘actual cash value’ determines payouts after damage claims are made – Replacement costs provide enough compensation for rebuilding without factoring depreciation while actual cash value deducts wear-and-tear before reimbursement occurs.

Finally look at specific perils covered under this section – windstorms? fires? vandalism?

Remember not all causes of damages may be included so make sure there aren’t gaps that leave potential vulnerabilities unaddressed.

Communicating with Your Insurance Agent

Once armed with insights from reviewing policy details yourself move onto reaching out directly to your insurance agent. They’re best suited providing answers tailored accurately according current plan features which helps clarify ambiguities might have surfaced during personal review phase earlier.

Do ask them about ways improving overall coverage too–for example increasing liability protections considering addition higher valued items (like high-end outdoor furniture accompanying lavish gazebos),or possibly exploring separate ‘Scheduled Personal Property’ endorsements certain scenarios where existing plans do not offer adequate safeguards due unique circumstances surrounding individual assets being considered here- namely: our beloved Gazebos!

Always remember, clear communication with your insurance agent helps in not only understanding current coverage but also finding potential improvements.

Conclusion

You’ve got the scoop on gazebos and insurance. They’re indeed covered under your homeowner’s policy, falling either into dwelling protection if attached or other structures coverage when detached. But remember: all policies aren’t created equal! The extent of your gazebo’s coverage can hinge upon its size, value, material type and more.

Don’t forget that good old upkeep plays a role too; keep it in top shape to avoid insurers crying foul over lackluster maintenance efforts. Plus, understand how potential risk factors like harsh weather conditions could potentially affect premiums – knowledge is power!

The key takeaway? Be proactive about understanding what’s covered (and what isn’t) in relation to your gazebo within your homeowners’ policy details – specifically looking at sections detailing ‘additional’ or ‘other structures’. And finally but critically important: have an open line with insurance agents for clarification and possible improvements on current coverages because every bit of information helps you protect this beloved backyard feature better!

- What Permits Do I Need for a Backyard Catering Business in the US? Complete Guide 2024 - November 15, 2025

- Is It Illegal to Shoot Your Own Dog? - November 15, 2025

- Why Add Outdoor Storage to a Backyard: Boost Space, Style, and Organization Today - November 15, 2025